What is Money?

Money is commonly recognized to have three primary, technical functions:

1) it serves as a unit of account (pricing goods and services in currency units);

2) a store of value (preserving wealth for future use); and

3) a medium of exchange (facilitating the purchase of goods and services).

While not recognized as one of money's primary technical functions, money’s use as a tool for control and influence can be just as important. For instance, central banks seek to influence interest rates (the cost of money) to discourage or encourage people and businesses to borrow and spend. Similarly, an authoritarian government might try to block donations from reaching human rights activists, using financial restrictions to suppress dissent and exert control. Finally, in our digital age, financial transactions serve not only as economic activities but also as potential avenues for surveillance and data harvesting, information that can be used to target and influence consumers.

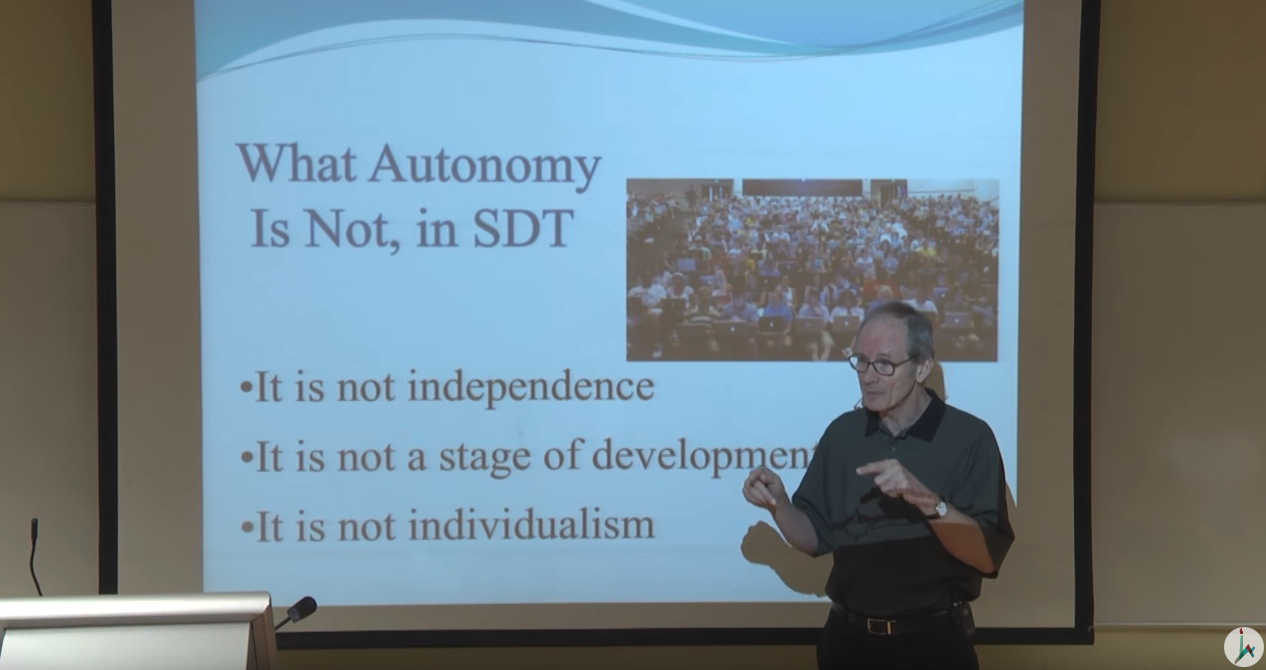

SDT and Monetary Rewards

Indeed, SDT has long recognized that money can be used as a tool for psychological control. SDT's earliest studies (Deci, 1971) showed that the administration of external rewards can, in some contexts, frustrate people's autonomy and undermine their intrinsic motivation (Deci et al., 1999). Though often described historically as an empirical anomaly for behaviorism, the undermining effect also bears important implications for economic theories and models, especially those related to labor markets and consumer behavior. Higher pay does not necessarily make for satisfied employees (Gagné, Nordgren, & Sverke, 2023), and reward points and discounts won't necessarily translate to long-term brand loyalty, especially if such offers don't support people's basic psychological needs (White & Tong, 2019).

SDT, Personal Finance, and Financial Wellness

Money permeates many aspects of daily life. Matters of personal finance often condition the goals people decide to pursue, and many of life’s big decisions are shaped and constrained by financial considerations. Research in SDT has begun to document how the motivations people have for managing their personal finances have important associations with their financial and overall psychological health. Recent studies indicate that autonomous motives for budgeting, paying bills, and learning about financial products and services are associated with financial literacy, greater financial self-awareness, and health (Di Domenico et al., 2022). On the other hand, controlled motives, and especially amotivation, have been linked to problematic behaviors and outcomes like overspending and financial stress. These insights underscore the significance of the quality of motivation in financial management and its impact on financial health. They also suggest that SDT can offer an empirically based applied framework for practitioners working to promote financial literacy and financial health.

Basic Psychological Needs and Macroeconomic Influences on Wellness

Against the backdrop of studies documenting the need-depriving effects of financial insecurity and its deleterious effects on psychological and physical health (e.g., Di Domenico & Fournier, 2014; Gonzales et al., 2014; Weinstein & Stone, 2018), SDT also recognizes that monetary and financial systems operate as a matrix of pervasive influences that can exert both proximate and distal effects on people's wellness and vitality. Macroeconomic factors, such as the extent of wealth concentration, monetary debasement, inflation, and interest rates, can influence the way people engage in financial behaviors and their overall financial wellness (Ryan, Di Domenico, Ryan, & Deci, 2017). SDT highlights psychological need satisfactions and frustrations as both an important pathway through which macroeconomic factors affect individuals and as a lens with which to characterize the effects of these factors on psychological health and wellness.

(2017)